Loading

A fintech startup sought to streamline its backend operations, including reconciliation, settlement, and customer resolution processes. With a high volume of transactions and reports generated daily, the manual handling of these processes was time-consuming, prone to errors, and required significant staff resources.

Startup

Fintech

6 months

UiPath, Visual Studio, SQL Server, Python, APIs, OCR Technology

The client faced several challenges:

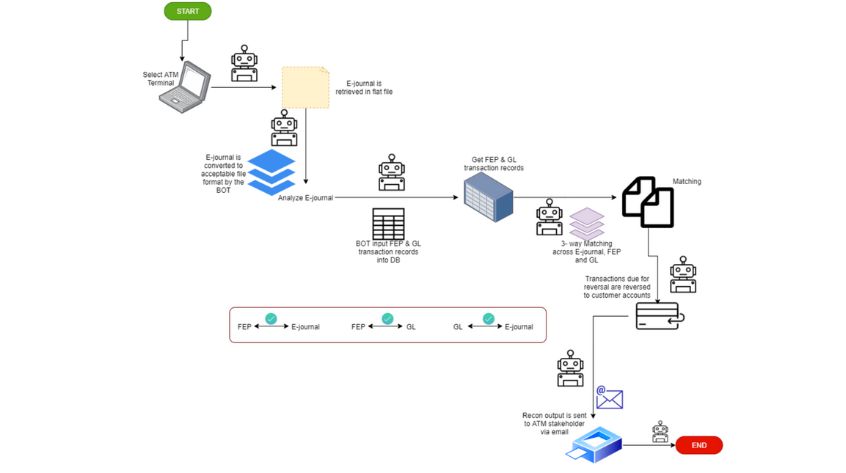

Process Mapping: Collaborated with the client’s staff to thoroughly document existing processes, including ATM-generated and server-stored reports.

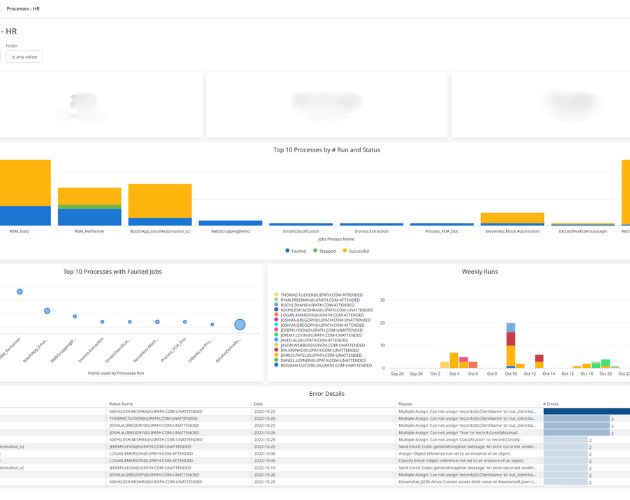

Automated Data Processing: Implemented an RPA solution to extract data from documents and reconcile accounts using a 3-way matching system.

Efficiency Gains: Reduced reconciliation and settlement time by over 90% with 99% accuracy through automation.

Automated Reporting: Streamlined daily report generation and delivery directly to staff emails, freeing up time for other tasks.

Customer Resolution Automation: SAutomated the resolution of customer complaints by cross-referencing IDs, with complex cases escalated to appropriate personnel.

The RPA solution reduced the time required for reconciliation and settlement by over 90%, freeing up staff to focus on more strategic initiatives.

The automation achieved a 99% error-free rate in processing, significantly improving the accuracy of settlements and customer resolutions.

The institution saved over $1 million annually by reducing manual errors, improving process efficiency, and reallocating staff resources to higher-value tasks.

Automated reporting and resolution processes allowed staff to start their day with key tasks already completed, increasing overall productivity.